“Market at Resistance: Sell on Rise or Breakout Rally Tomorrow?”

19-02-2026

Markets witnessed a Strong Sell-Off session today as both Nifty and Bank Nifty faced rejection from higher levels and closed near important support zones. The price action clearly reflects distribution near resistance rather than aggressive buying.

Momentum indicators are cooling off and short-term structure is shifting from bullish continuation to range-bound with a negative bias.

This makes tomorrow’s session extremely level-driven and tactical.

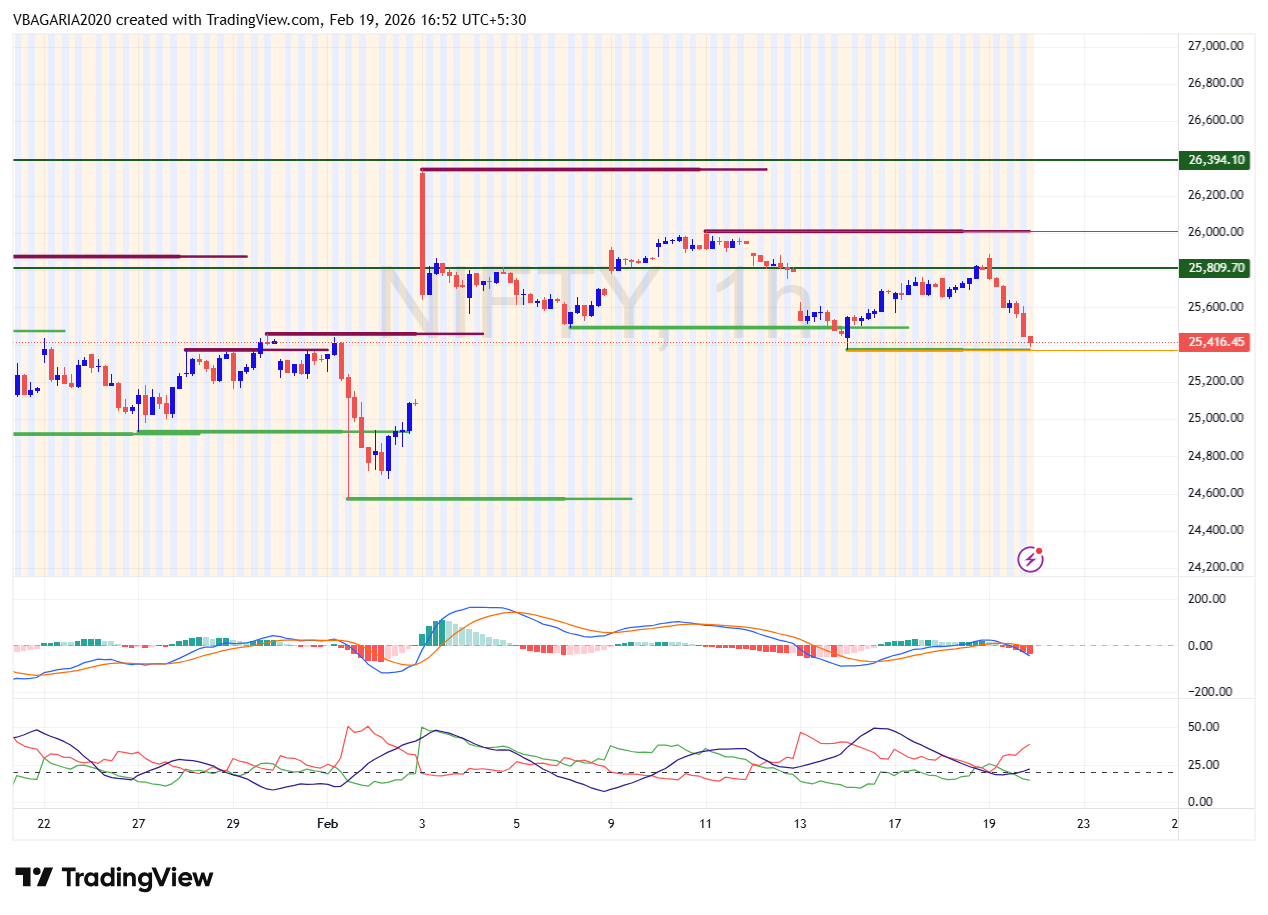

Nifty Price Action Analysis

Nifty attempted to sustain above the 26,000 zone but repeatedly faced rejection near this resistance band. Sellers remained active at higher levels and the index closed near intraday support, showing weakness into the close.

The current structure indicates formation of lower highs on the intraday chart, suggesting smart money selling on every rise rather than panic selling. Momentum has turned slightly negative and the market now needs a strong trigger to regain upside strength.

Key Levels to Watch

-

Immediate Resistance: 25,800 – 26,000

-

Major Resistance: 26,400

-

Immediate Support: 25,400

-

Breakdown Zone: 25,200 – 25,000

As long as Nifty trades below the 26,000 zone, upside will remain capped and rallies may continue to face selling pressure.

Strategy for Tomorrow – Nifty

The preferred strategy remains sell on rise unless a strong breakout occurs.

If Nifty trades below 25,500:

-

Selling pressure can push the index toward 25,200

-

Further breakdown may extend toward 25,000 and 24,800

19-02-2026

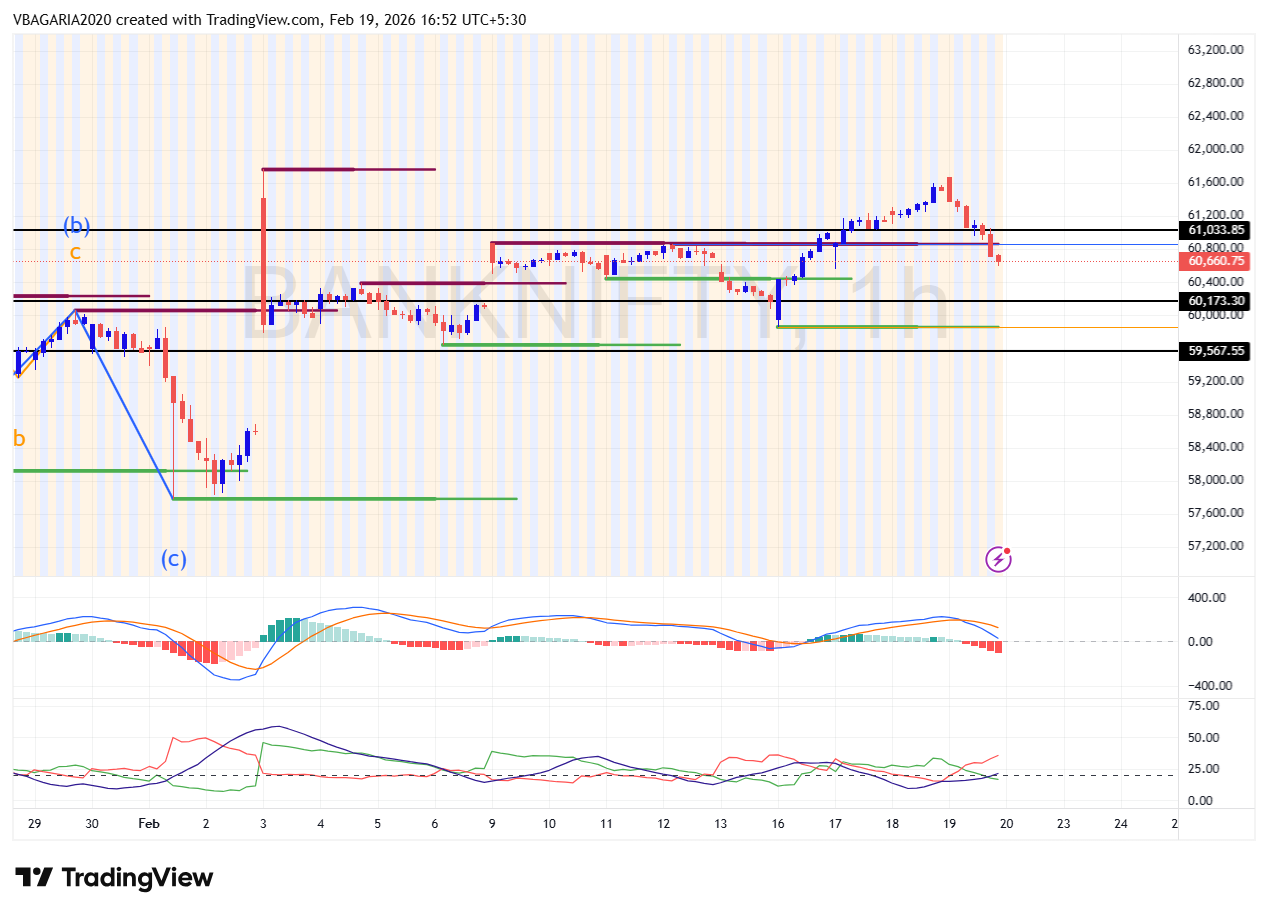

Bank Nifty Price Action Analysis

Bank Nifty showed clear rejection from the 61,500–61,700 supply zone and slipped below its intraday structure support. The closing near day lows signals institutional unwinding and lack of fresh buying at higher levels.

The index is currently attempting a range breakdown, and unless key resistance is reclaimed quickly, short-term weakness may continue.

Key Levels to Watch

-

Immediate Resistance: 61,000

-

Major Resistance: 61,600

-

Immediate Support: 60,200

-

Major Support: 59,500

The formation of lower highs and weakening momentum suggests that upside remains capped for now.

Strategy for Tomorrow – Bank Nifty

As long as Bank Nifty trades below 61,000:

-

Selling on rise remains the preferred strategy

-

Downside targets: 60,200 followed by 59,500

A bullish setup will only emerge if the index breaks and sustains above 61,700 with strong buying interest. Such a move can trigger short covering toward 62,200–62,800. Until then, rallies are likely to be sold into.

19-02-2026

Final Market Strategy for Traders

The Short-term momentum has clearly weakened. This is a phase where discipline and level-based trading matter more than prediction.

Trading Approach for Tomorrow

-

Maintain a sell-on-rise approach

-

Avoid aggressive longs near resistance

-

Buy only on confirmed breakout with volume

-

Watch the first 30 minutes range carefully for direction

This is a tactical market, not a trending one. Quick decisions, strict stop losses, and patience will define trades.

When markets shift from momentum to consolidation, smart traders focus on levels, not emotions.

19-02-2026

VIKASH BAGARIA ---SEBI Research Analyst INH300008155, BSE Enlistment No-5426

Disclaimer :- The investments discussed or recommended in the market analysis, research reports, etc. may not be suitable for all investors. Investors must make their own investment decisions based on their specific investment objectives and financial position and only after consulting such independent advisors as may be necessary.

“Investments in Securities market are subject to Market Risks, Read all the related documents carefully before Investing.”

Registration granted by SEBI & Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to Investors.

For Research Risk & Disclosure Please Visit :: https://chartntrade.com/research-disclaimer