“Stock SIP Mastery: Crafting Your Path to Long-Term Wealth”

26-06-2025

Build Long-Term Wealth With Stock SIPs

Invest smarter by spreading your money over time instead of risking everything at once. Small, regular investments can lead to significant wealth creation.

Systematic Investment Plans (SIPs) aren’t just for mutual funds—they can be a powerful way to dollar-cost average into high-quality stocks, building wealth over time. In this post, we’ll walk you through setting up a stock-market SIP, step by step, so you can harness the magic of compounding for long-term value creation.

26-06-2025

1. What Is a Stock-Market SIP?

A SIP in stocks means you invest a fixed amount into one or more shares at regular intervals (e.g., monthly). This approach helps you:

-

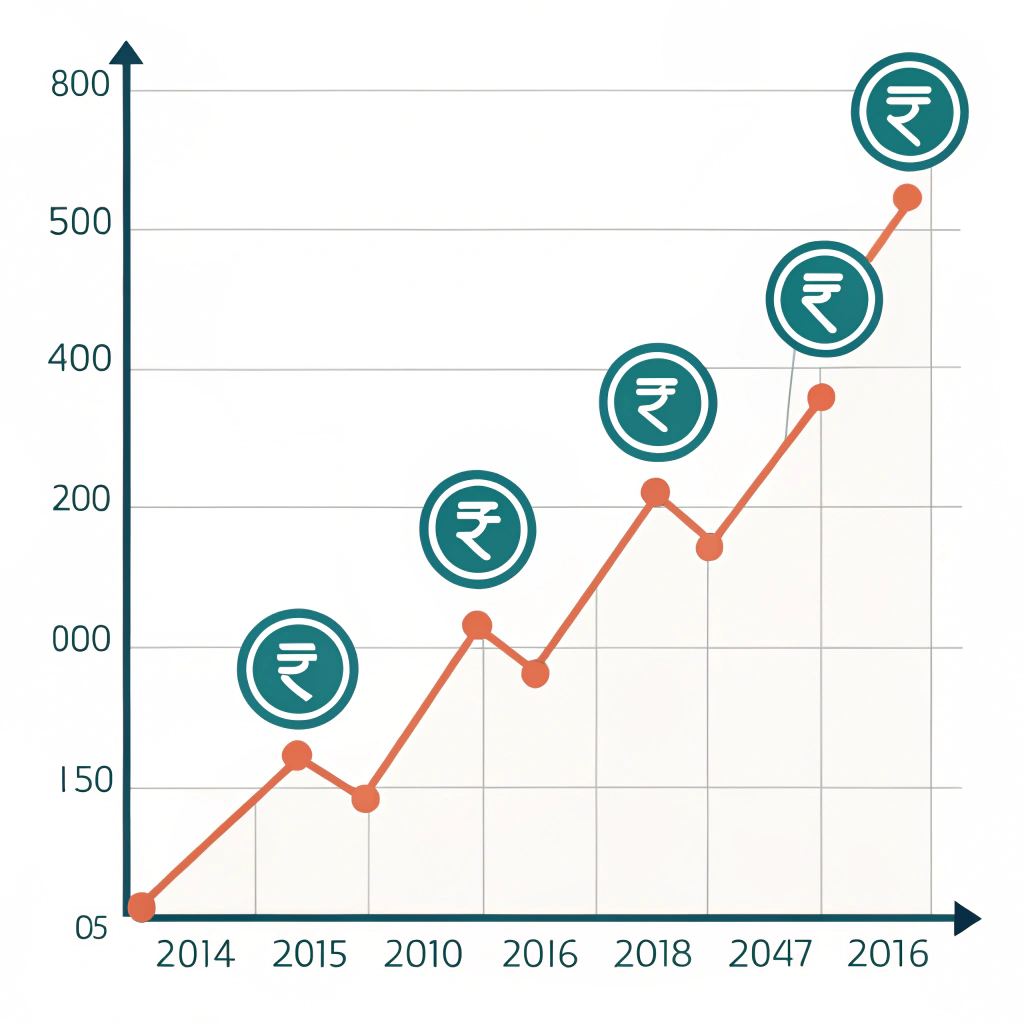

Average out market volatility (you buy more when prices are low and fewer when prices are high).

-

Build discipline—you don’t wait for “perfect timing.”

-

Harness compounding as dividends and price growth accumulate over years.

26-06-2025

3.Why Choose SIPs for Stocks?

Protection from Volatility

SIPs shield you from market ups and downs by spreading investments over time.

Enforced Discipline

Automatic investing prevents emotional decisions during market swings

Accessible Entry

Start with small amounts and steadily build your portfolio

26-06-2025

5. Choosing Your Stocks

-

Quality First: Look for companies with steady earnings, strong return on equity (ROE ≥15%), and healthy debt ratios.

-

Sector Diversification: Spread across 3–5 sectors (e.g., consumer staples, technology, financials) to reduce concentration risk.

-

Blue-Chips + Growth: Blend large-caps for stability with a small allocation to mid/small-caps for higher growth potential.

Reliable performane: Seek stocks with history of weathering market downturns and delivering long-term returns.

Technical Weightage: The Stocks which are above long term Moving Average in Weekly & monthly Charts.

26-06-2025

6. Setting Up Your SIP: Step by Step

-

Open a Demat & Trading Account: Choose a broker with low brokerage, reliable app, and good research support.

-

Select Stocks & Allocation: Decide your monthly amount (e.g., 5,000), then allocate (e.g., 2,000 in HDFC Bank, 1,500 in TCS, 1,500 in Titan as per your preffered stock.

-

Automate the Order: Set calendar reminders and keep the Monthly purchase going.

-

Monitor Quarterly: Check fundamentals, rebalance annually if any holding drifts beyond ±20% of target.

Choose a schedule that aligns with your financial situation:

- Monthly: Most popular, aligns with salary cycles

- Weekly: More entry points, smaller amounts each time

- Quarterly: Fewer transactions, good for larger amounts

Consider your cash flow patterns when deciding

26-06-2025

7. Risk Management & Exit Strategy

-

Emergency Fund First: Ensure 6–12 months of expenses parked in liquid assets.

-

Stop-loss for Smaller Positions: For high-volatility mid-caps, set a mental stop-loss (e.g., 15% drawdown).

-

Review Life Goals: As goals change (marriage, home purchase), adjust SIP amount or switch to more conservative plays like dividend-payers.

26-06-2025

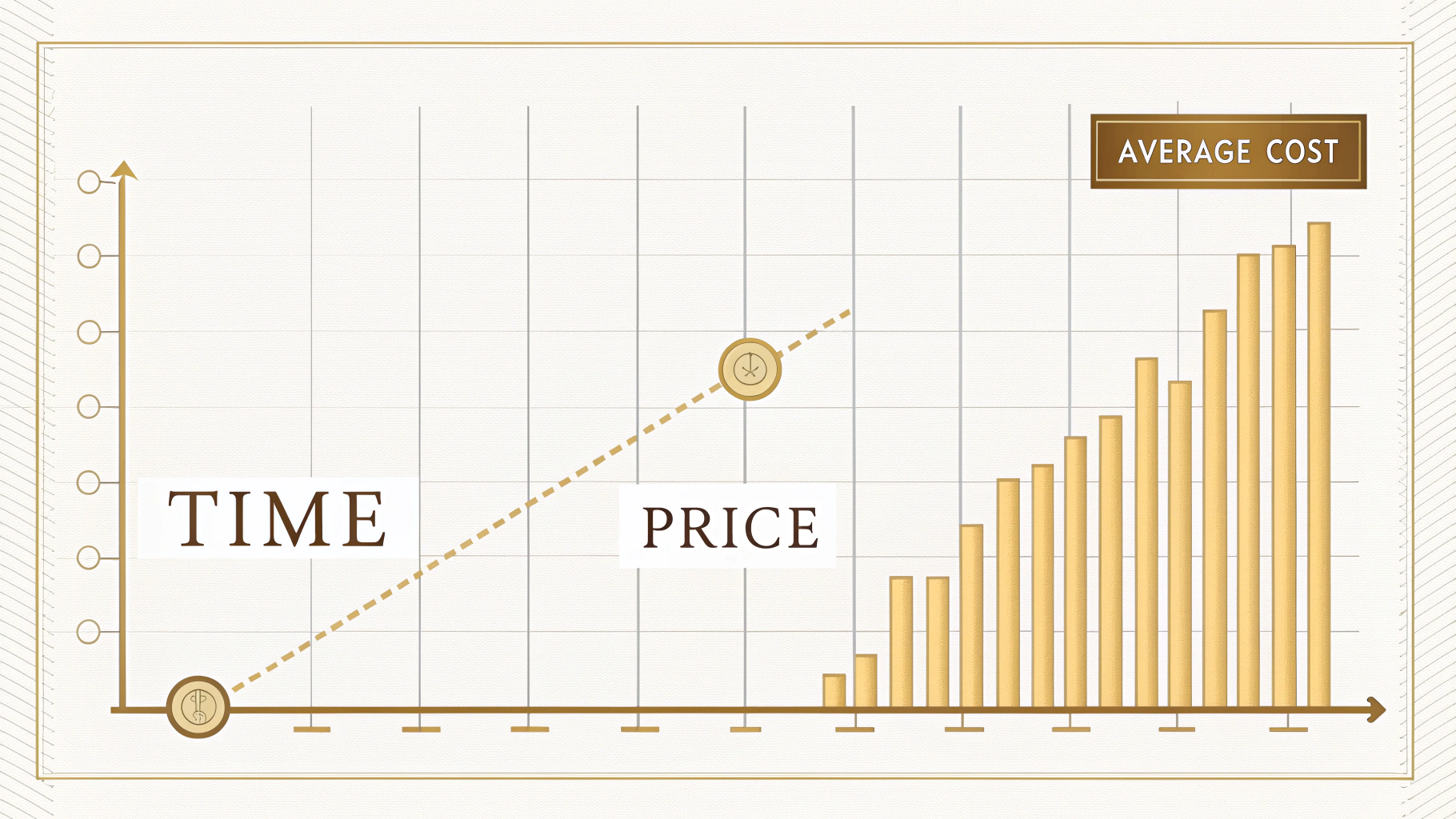

The Magic of Time in SIP Investing

The longer you maintain your SIP, the more powerful the compounding effect becomes. Early years may show modest growth, but patience unlocks exponential returns.

A stock-market SIP marries discipline with the power of compounding—your ticket to long-term wealth creation. Start small, stay consistent, and let time work its magic. Remember: the best time to start was yesterday; the second-best time is today!